By Bhaven Shah and Garv Sultania

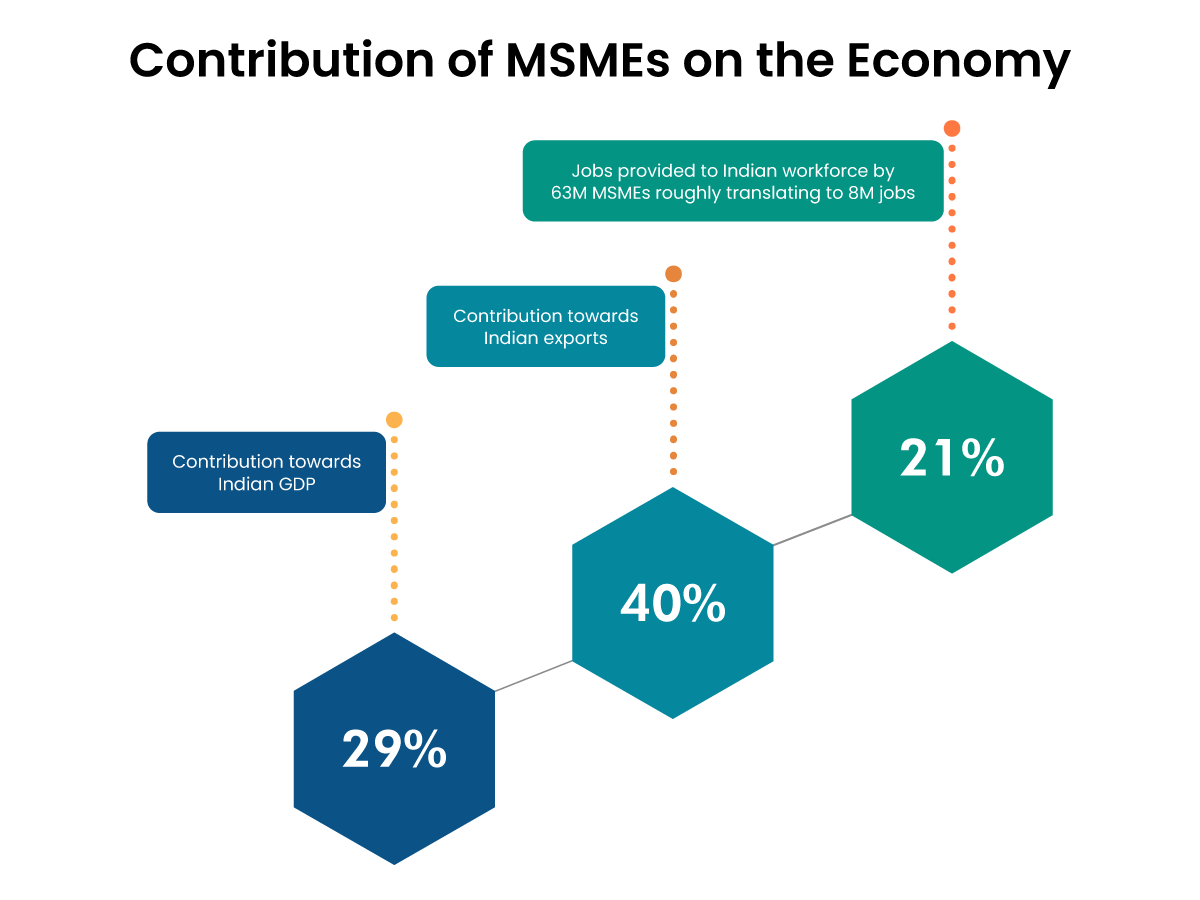

Micro, small and medium enterprises (MSMEs) contribute 29% to India’s GDP and 40% of India’s exports. 6.3 crore such MSMEs employ 21% of India’s workforce, translating into 80 million jobs. Some initiatives by the Government have contributed to the holistic growth of this sector. For example, these include MSME CHAMPIONS, Samadhaan portal, Trade Receivables Electronic Discounting System (TReDS) and Government e-Marketplace (GeM). However, MSMEs continue to encounter serious issues relating to delayed payments that choke cash flows and even lead to insolvency.

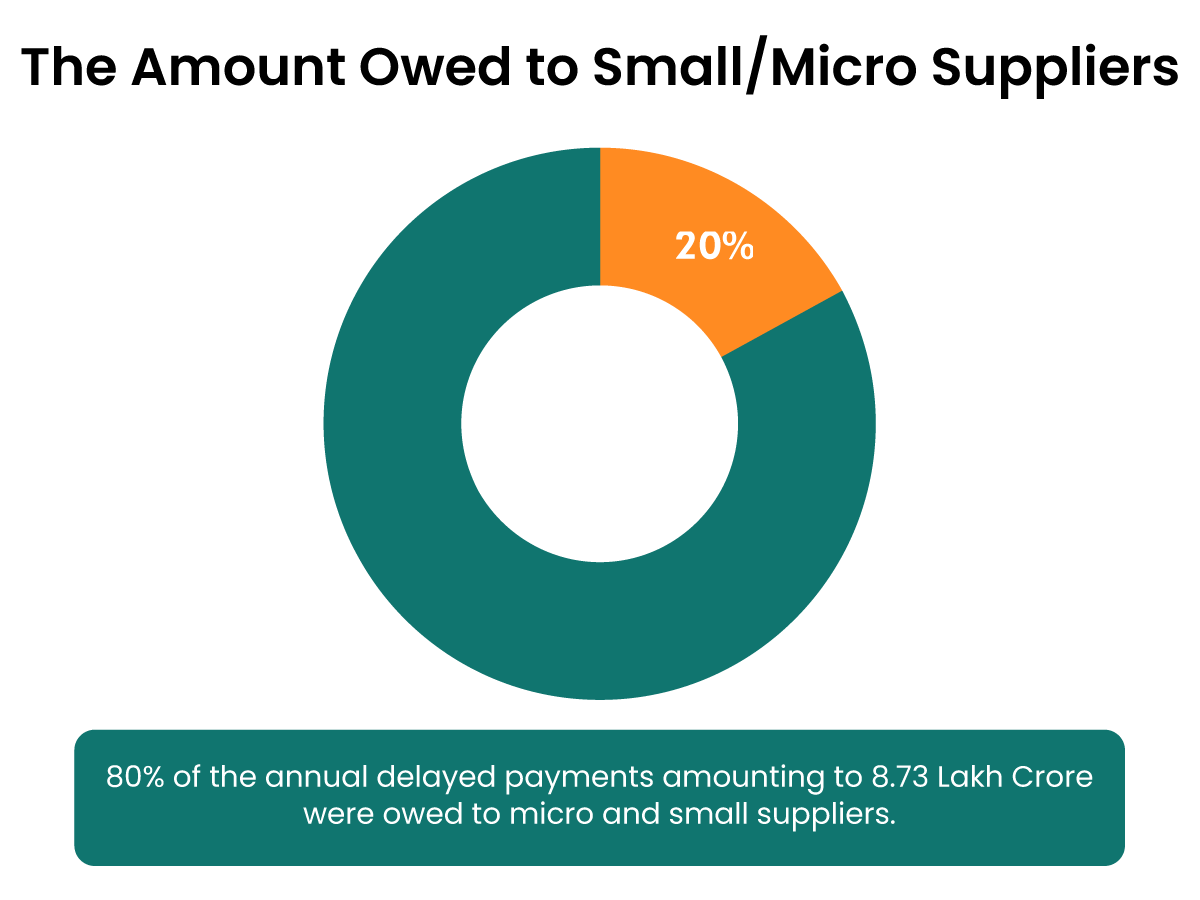

A recent report by the Global Alliance for Mass Entrepreneurship (“GAME”), Dun & Bradstreet, and Omidyar Network India reveals the problem. According to it, 80% of annual delayed payments (amounting to INR 8.73 lakh crore) were for micro and small suppliers. Interestingly, one can avoid 72.4% of such instances through an effective way to tackle the menace of delayed payments.

The current mechanisms usually involve informal follow-ups. Currently, less than 1% of eligible enterprises, representing 1.3% of delayed payments, use the MSME Samadhaan portal for formally recording delays. The lack of any tangible outcomes and high rejections have rendered it a mere filing tool.

The final recourse of going to court has its own issues. These range from being resource-heavy and the existence of power asymmetry to an already overburdened justice delivery system. Some other concerns include:

- Supplier’s fear of retaliation from buyers.

- Lack of awareness.

- Lack of a streamlined and accessible system.

- The complex and lengthy recourse process itself has cumulatively led to low success, thereby limiting trust in the system.

One of the solutions proposed in the GAME Report is the entry of Online Dispute Resolution (“ODR”) service providers. As a result, this will ensure faster (and thereby effective) resolution of payment-related disputes. The use of ODR will play a tremendous role in easing the burden of Micro & Small Enterprise Facilitation Councils (“MSEFCs”). Unlocking ODR by leveraging technology is thus integral to addressing the concern of delayed payments for suppliers in the MSME ecosystem.

ODR’s usefulness in India

If a buyer delays payments to the supplier beyond 45 days, the law provides for strict penalties. This includes paying the MSME compound interest at monthly rates three times the RBI’s notified rates. Buyers also must make disclosures and have reporting obligations around delayed payments. Failure to do so attracts serious penalties and consequences for both the buyer and officers-in-charge of the buyer. MSMEs can register such disputes online on the Samadhaan portal or directly file with the jurisdictional MSEFC. After evaluating the application, the MSEFC may either convert it into a case or reject the application. The concerned MSEFC may itself conduct conciliation followed by arbitration, or refer it to an Alternative Dispute Resolution (“ADR”) institution.

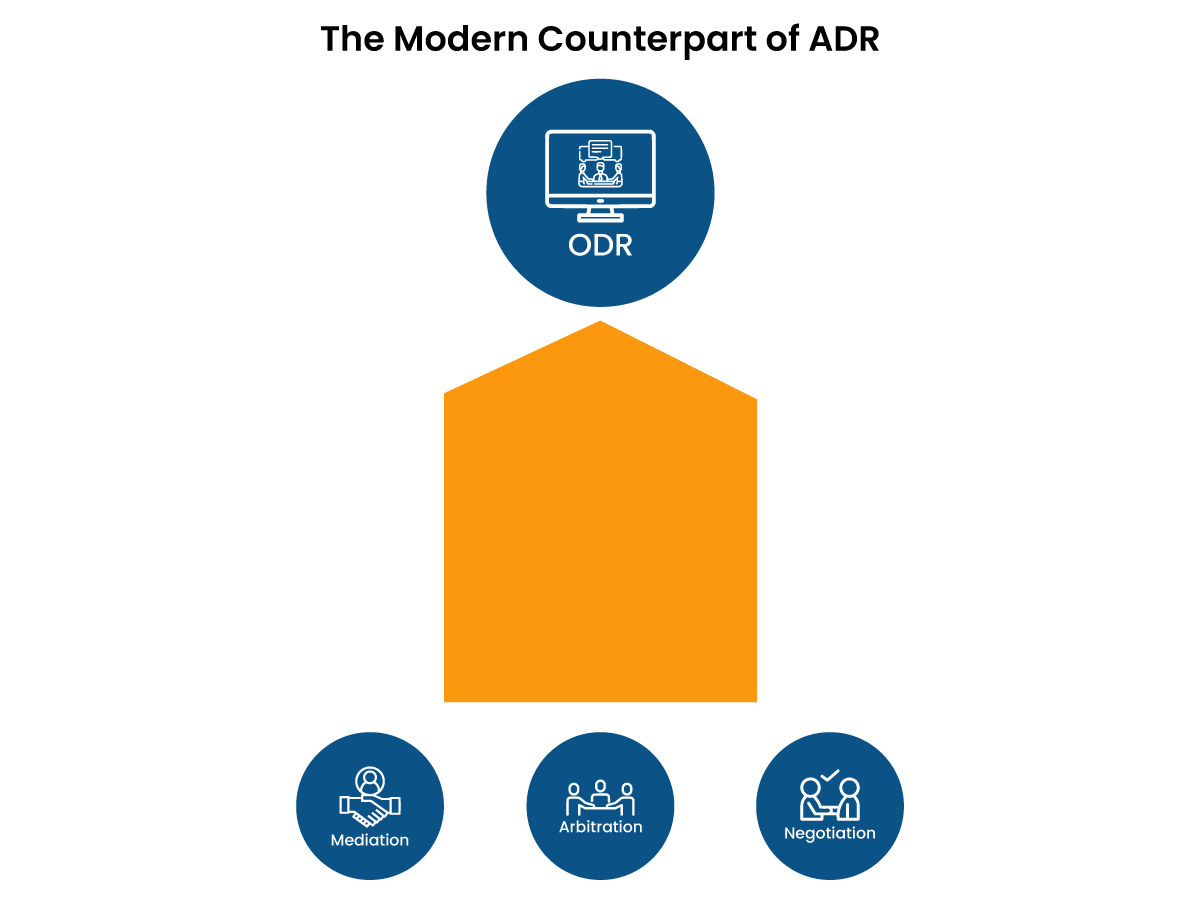

ODR is the modern counterpart of ADR mechanisms like negotiation, mediation, arbitration, etc. Powerful communication technologies, case management tools, and advanced technologies allow ODR to curate a quick, effective, and efficient case-specific solution.

The law permits ODR, and it has gained wide recognition in India from the judiciary, the government, and business enterprises. For instance, the National Payments Corporation of India (“NPCI”) has mandated ODR for complaints about failed transactions on UPI. INGRAM, SEBI SCORES, RBI CMS, MahaRERA, and RTI Online are other examples of widely-used ODR systems.

Several enterprises including banks, e-commerce companies, fintechs, and start-ups have also included ODR in their dispute resolution frameworks.

The ODR advantage for solving delayed payments

The time is ripe for ODR to solve the issue of delayed payments constricting and crippling MSMEs.

This is possible by a two-pronged approach:

- First, a dedicated supplier-side technology platform accessible 24×7 in multiple languages, encompassing:

- A layered approach to establish communication and convey consequences to buyers to ensure increased awareness

- Automating processes and standardization to ensure a streamlined process

- Integrated reporting to concerned authorities to ensure increased recoveries, prompt payments, increased action against delays, and reduced rejections by MSEFCs

- Second, exploring the enabling provisions of the law which permit referral of disputes by MSEFCs to ADR institutions.

Where the incumbent setup involves significant resources, ODR provides a superior experience, while being pocket-friendly, quick, and convenient. A fully integrated platform will enable parties to track the end-to-end progress of the entire journey. It will also provide actionable data to explore possibilities of dispute avoidance.

The Government is focused on supporting MSMEs as the growth driver of India’s economy. Hence, the question is not whether to explore ODR to solve delayed payments, but rather how soon to implement it.

Bhaven Shah is a Co-founder of Presolv360.

Garv Sultania is a lawyer keenly interested in the intersection of technology and law. He is a part of the Strategy team at Presolv360.

Adapted from How to tackle delayed payments to MSMEs, originally published in Business Standard.