Insurance complaints in India surged from 684 in Q1 to 974 by Q2 of 2025 marking a 45% increase in such disputes. The value of such claims rose from Rs 83.5 crores to Rs 119.5 crores pointing towards a 43% increase. Furthermore, 7 out of 10 Indians risk losing everything due to issues like high costs and medical inflation. Insurance claim related disputes are rising because of certain malpractices and poor third-party administrator (“TPA”) oversight with health insurance constituting the subject of 68% of complaints. TPAs often make decisions unilaterally on crucial issues policy denial and claim approval.

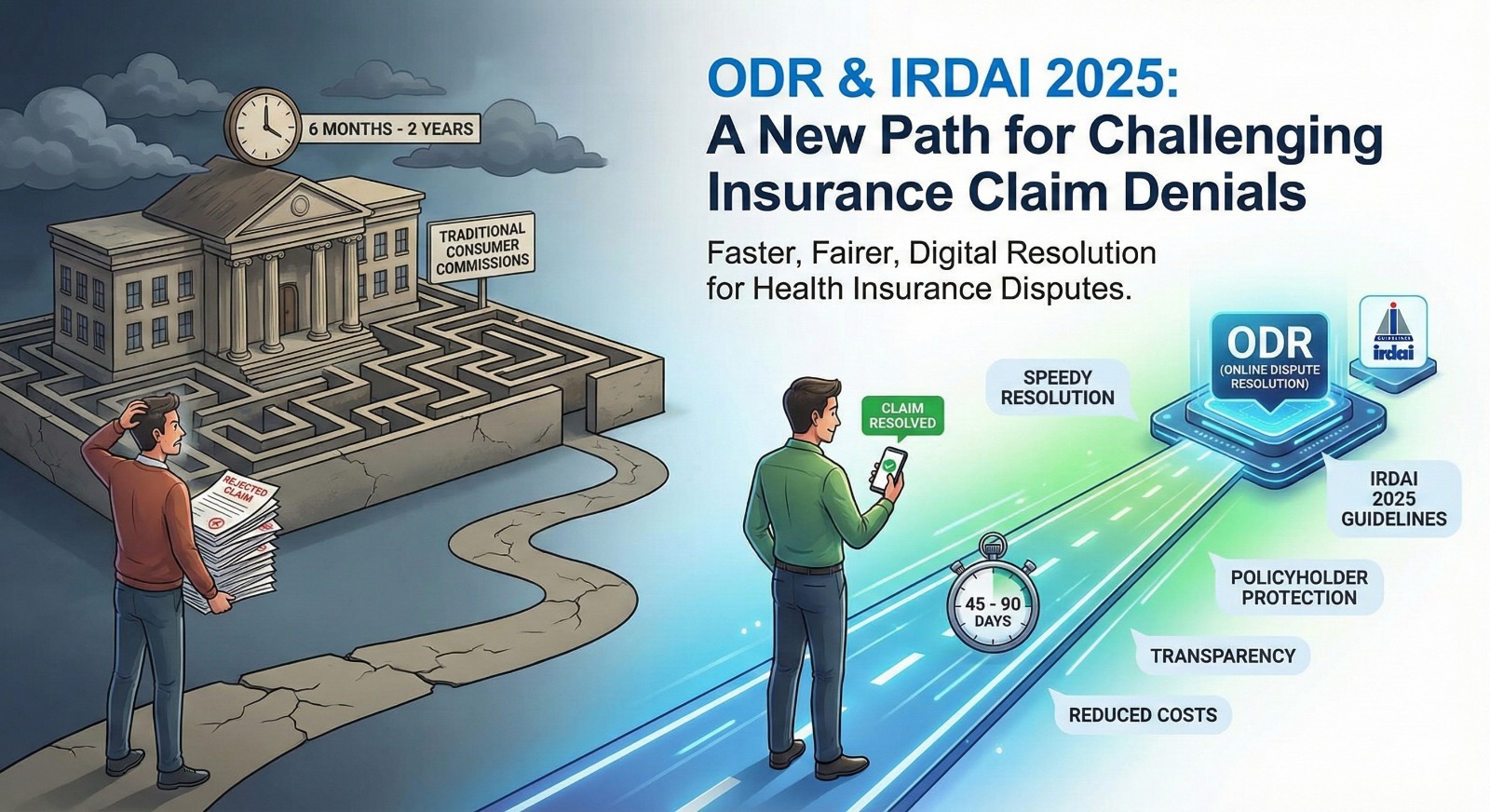

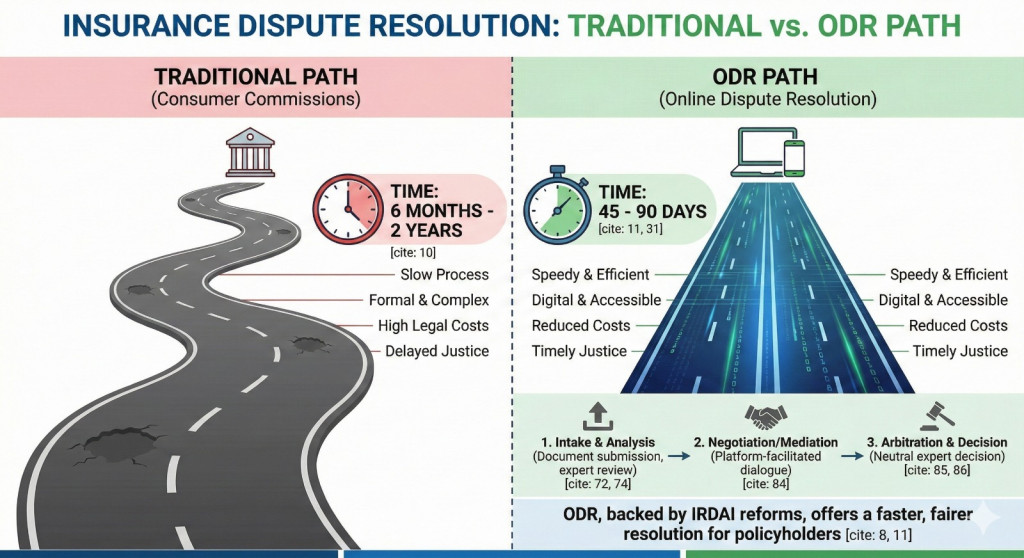

The Insurance Regulatory and Development Authority of India’s (IRDAI)rooted in policy holder protection with changes being made, such as pre-existing conditions, moratorium period, transparency and standardized exclusions. The combination of rising insurance disputes and IRDAI’s rules provide a ripe environment for ODR platforms to resolve such disputes. Previously, policy holders did not have adequate protections and access to timely dispute resolution. Consumer commissions at the district level take 6 months to 2 years to render judgement. However, ODR allows speedy and efficient resolution cutting the period to an approximate period of 45-90 days, this expedition becomes a crucial aspect of access to justice especially in cases of healthcare insurance related disputes, where the Parties are already going through hardships in terms of high costs that end up in them losing life savings and houses. ODR does not only have a commercial aspect to ensure speedy resolution but a humanitarian ground to ensure that parties are not drowned in medical bills.

This article analyzes IRDAI’s guidelines to understand how these are extending towards policyholders and creating an environment suitable for ODR. Furthermore, the article sheds light on the recent order passed by the District Consumer Disputes Redressal Commission (DCDRC) regarding the ambit of a TPA.

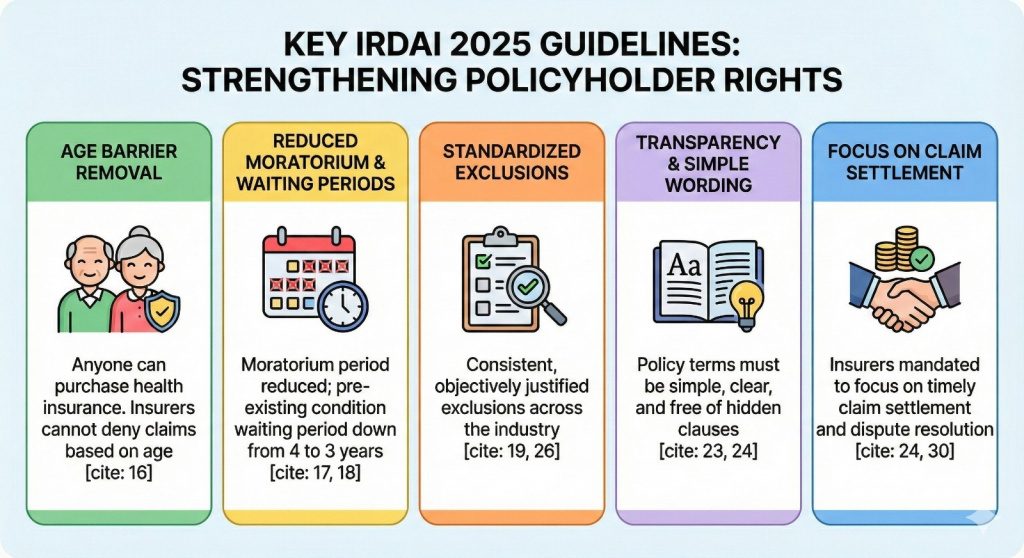

IRDAI 2025: Bird’s Eye View (Guidelines)

- Age Barrier Removal – Anyone can purchase health insurance. Insurers cannot deny policy claims based on age.

- Reduction of Moratorium Period – The moratorium period refers to the period after which the insurer cannot deny a claim for non-disclosure unless it is proven that there was fraud.

- Reduction of Waiting Period – The waiting period for pre-existing years has been reduced from 4 years to 3 years.

- Standardization and Rationalization of Exclusion – The IRDAI has introduced consistent exclusions to ensure similarity in the industry.

a) Pre-Existing diseases can be excluded for a period of 48 months based on the product design

b) Specific procedure or diseases can still have waiting periods provided they are disclosed transparently

c) A standard 30-day waiting period applies regardless and no illnesses except accidents are covered - Transparency and Claim Settlement Focus – The IRDAI has mandated insurers to use simple wording to reduce the incidence of disclosure. Furthermore, insurers have to focus on settling claims to remove hidden clauses and resolve the dispute in a timely manner.

- Portability and Continuity Benefits – Policyholders switching to another insurer will have continuity benefits with respect to pre-existing conditions based on their prior policy history.

- Exclusion must be objectively justified – Any clauses, sub-limits or restrictions applied must be backed by clear reasoning. Arbitrary or vague condition will no longer be allowed.

IDRAI 2025 guidelines are rooted in the benefit of the policy holder. The guidelines address the main cause of insurance complaints (mis-selling) by mandating standardization of clauses and simple wording in the policy. Furthermore, insurers have to offer timely dispute resolution by focusing on settling claim. ODR offers an attractive opportunity to resolve disputes within 45-90 days. It offers the consumer quick relief and the insurer reduced cost and speedy compliance with the rules.

In a decision by the DCRDR decision by the Ranga Reddy bench in Hyderabad, the court held that a TPA in insurance is only a service facilitator and cannot unilaterally decide to impose deductions, reject claims or decide claims without the insurer’s authorized signatory note. A TPF unilaterally deciding amounts to a “deficiency in service” and the insurer and TPA are held jointly liable.

The policyholder in this case was awarded the refund amount deducted of Rs 19,535 + 9% Interest on Amount Deducted + Rs 10,000 (Mental Agony) + Rs 5,000 (Litigation costs). The IRDAI warned the insurance company to not engage in unfair trade practices to comply with IRDAI guidelines. Non-Compliance with the order within 45 days would attract additional compensation.

Furthermore, the Rajya Sabha passed the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 (“Bill”)on December 17, 2025 with the aim of amending Insurance Act, 1938 (Insurance Act); the Insurance Regulatory and Development Authority Act, 1999; and the Life Insurance Corporation Act, 1956. The bill introduces reforms such as policyholder’s education, expansive powers of IRDA (Investigate violations to ensure compliance) and protect policyholder’s data in compliance with the DPDP Act, 2023 that are in the interests of consumers. The bill does not explicitly recognize ODR for dispute resolution.

However, under Section 14 (substituted) the bill mandates insurers to maintain accurate and electronically accessible policy records and claims and include reasons for rejection/acceptance. This forms the evidence backbone of ODR. The Arbitration (Amendment) Bill, 2024 represents though a positive step forward, as it expressly incorporates provisions for online hearings within arbitral proceedings. This legislative recognition shows governmental support for technology-enabled dispute resolution in insurance disputes as well.

An understanding of the IRDAI guidelines, Bill, Arbitration (Amendment) Bill, 2024 and DCRDR decision point towards a regime that is more tilted towards protecting policyholders and ODR. Insurers have to comply with such guidelines forcing them to adopt ODR. Specialized-ODR platforms for resolving for insurance claim disputes are emerging as well.

The IRDAI has recently established the Bima Bharosa portal to ensure speedy dispute resolution for policyholders by allowing them to lodge and track complaints against insurers and TPAs. Policyholders can log in, submit a complaint and receive a unique token number to monitor progress. Complaints registered through the portal are forwarded to insurer’s grievance system and IRDAI’s repository as well. The complainant has the option to escalate the complaint to the insurance ombudsman after 15 days in case insurer’s response is unsatisfactory.

Turning IRDAI Guidelines to Outcomes: The Role of ODR in claims redressal

- Mis-Disclosure – The applicant cannot be denied the insurance claim because of not disclosing the pre-existing condition. The waiting period has been reduced. Misrepresentation has to be visible. Otherwise, the policy claim cannot be denied. In ODR, the mediator can review the disclosure terms and if the terms are unclear, they will side with the policyholder. Furthermore, the IRDAI rules mandate simple terms to ensure transparency and understanding.

- TPA Overreach – There have been instances of TPAs denying insurance claims without the insurer’s authorization. TPAs cannot independently take actions. ODR investigation would highlight the unethical practices of TPAs. This would force the insurer to honor the claim. Furthermore, this was addressed in the latest decision by DCRDC to honor insurance claims when the TPA takes independent action without the insurer’s approval. In ODR, an arbitrator could hold the insurer and TPA liable for unethical trade practices.

- Waiting Period Technicality – The waiting period for pre-existing conditions has been reduced to 3 years. Exclusions must be objectively justified. ODR would involve the arbitrator evaluating whether the clause applies to claimant’s specific condition and strikes down the relevant clauses.

- Policy Wording Ambiguity – The wording of the policy has to clear and simple. For example, a clause “hospitalization benefit excludes certain procedures”. Insurers have to simplify wording and ambiguous terms would be interpreted in favor of the policyholder.

- Claim Amount Cap – The sub-limits in the insurance policy must be actuarially justified and transparently disclosed. For example, a cap of Rs 50,000 for mental illnesses must be disclosed with proper reasoning. ODR allows the arbitrator to evaluate the cap disclosure. If it has not been disclosed, then arbitrators can award the full amount while passing the award.

- Mis-Selling – The value of disputed insurance claims is Rs 119.5 crore. One of the main reasons for such disputes is mis-selling. Agents in insurance companies usually are under pressure and potentially misrepresent regarding the terms, benefit and limitations. The consumer can immediately raise a complaint and resolve the dispute in 45-90 days as opposed to consumer commissions that take more than 6 months to resolve such disputes.

How ODR Resolves Insurance Disputes?

- Intake and Case Registration – Policyholders begin by submitting a through a platform’s website and app. They will have to submit relevant documents such as hospital bills, insurance claim correspondences, policy papers and rejection letters.

- Expert Analysis of Grievance and Documentation – Insurance experts analyze the complaint and identify the root cause of the delay. They assist in preparing documentations, highlighting IRDAI rules and identify any compliance issues.

- Mapping the appropriate dispute resolution channel – Based on the complaint type and severity the platform determines the appropriate channel such as:

a) Direct negotiation with the insurer’s grievance cell

b) Escalation to the insurer’s grievance office

c) Filing a complaint with IRDAI’s Bima Bharosa portal

d) Preparing a case for the insurance ombudsman

e) Support escalation to consumer forums if needed - Filing and Escalation – Experts draft a complaint and escalate it if necessary. Cases are filed digitally and can be tracked through the platform as well. This ensures compliance with IRDAI rules.

- Negotiation and Follow-Up – The ODR service provider allows the parties to engage in arbitration, mediation and negotiation to allow the parties to reach a mutually agreeable solution. A neutral arbitrator who is an insurance and legal expert is appointed.

- Decision – The arbitrator approves the claim, rejects it or partially approves it based on evaluating the case and evidence put forth.

Conclusion

IRDAI’s recent reforms have rebalanced the insurance ecosystem by tightening disclosure standards, limiting arbitrary exclusions, and reinforcing accountability in claims processing. However, regulation alone does not guarantee relief. It must be translated into enforceable outcomes.

This is where ODR creates tangible value. By structuring grievances, demanding documented justification from insurers, and aligning escalation with IRDAI timelines, ODR turns policyholder rights into practical remedies.

The result is faster resolution, fewer unfair denials, and a clearer signal to insurers that compliance is not optional. As disputes increasingly migrate to digital resolution channels, ODR is emerging as the operational backbone of consumer protection in insurance.

Sources: Business Standard, HDFC Ergo, Times of India, Economic Times, Dispute Resolution Online (Handbook), Insurance Samadhan’s website, Polifyx and White Ocean’s Blog.